Get the free wells fargo medallion signature guarantee form

Show details

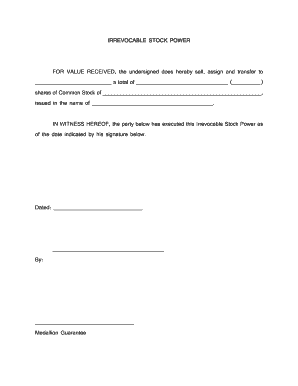

Stock Power Form Section A: Current Owner Information A new form is needed for each account and company of stock you are transferring. 1. FOR VALUE RECEIVED, the undersigned does (do) hereby sell,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign wells fargo medallion signature guarantee form

Edit your does wells fargo do medallion signature guarantee form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wells fargo stock certificate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit wells fargo site pdffiller com site blog pdffiller com online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit medallion signature form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out wells fargo medallion stamp form

How to fill out Wells Fargo Stock Power:

01

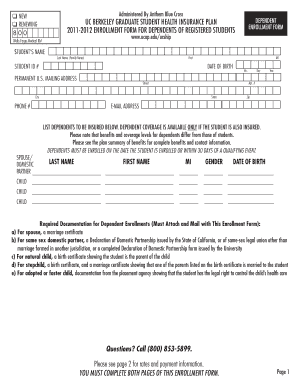

Obtain a copy of the Wells Fargo Stock Power form, which can typically be found on the Wells Fargo website or requested from a Wells Fargo representative.

02

Read the instructions on the Stock Power form carefully to ensure you understand the requirements and process for completing the form.

03

Provide your personal information, including your name, address, and contact details, in the designated sections of the Stock Power form.

04

Indicate the number of shares you wish to transfer or assign in the appropriate section of the form.

05

Sign the Stock Power form as the owner of the shares being transferred or assigned. Ensure your signature is consistent with the way your name appears on the stock certificate or in the stock records.

06

If you are transferring or assigning the shares to someone else, the recipient's name, address, and contact details must be filled out in the appropriate section of the form.

07

If required, provide any additional documentation or information as specified in the instructions. This may include attaching a copy of the stock certificate or providing a Medallion Signature Guarantee from a qualified financial institution.

08

Review the completed Stock Power form to ensure all the necessary fields have been filled out accurately and legibly.

09

Make copies of the completed Stock Power form for your records.

10

Submit the original completed and signed Stock Power form, along with any required additional documentation, to the specified address provided on the form or as instructed by Wells Fargo.

Who needs Wells Fargo Stock Power:

01

Individuals who wish to transfer or assign ownership of their Wells Fargo stocks to someone else.

02

Executors or administrators of estates who need to transfer or assign Wells Fargo stocks as part of their fiduciary duties.

03

Trustees who need to transfer or assign Wells Fargo stocks according to trust agreements.

04

Legal representatives or attorneys acting on behalf of individuals or entities that need to transfer or assign Wells Fargo stocks.

05

Shareholders who want to gift or donate their Wells Fargo stocks to charitable organizations or other recipients.

Fill

medallion signature guarantee form

: Try Risk Free

People Also Ask about medallion stamp wells fargo

What is the discount for Wells Fargo employee stock purchase plan?

Allows contributions up to 15% of base salary. 15% discount on purchase price of stock.

How do I transfer money from Wells Fargo Advisors?

Transfer funds at any time To transfer funds to or from your brokerage accounts, simply sign on to Wells Fargo Online® and select Transfer and Pay.

Does Wells Fargo let you buy stocks?

With a single sign-on, you'll have convenient access to your Wells Fargo Advisors investment and Wells Fargo banking accounts on your PC, laptop, tablet, and smartphone. Place trades online for stocks, no-load mutual funds, exchange-traded funds, options, and money market mutual funds (PDF) online.

How do I transfer money from my brokerage account to my bank account?

When you want to withdraw money from brokerage account, here's how: Log in to your account on your broker's site. Go to the transfers page. Where you find this option depends on the broker you use, but it's usually on the main navigation bar. Choose the amount and the withdrawal method.

How do I withdraw money from my Wells Fargo brokerage account?

To transfer funds to or from your brokerage accounts, simply sign on to Wells Fargo Online® and select Transfer and Pay.

What is the Wells Fargo preferred stock dividend?

This dividend equals $0.35156 per depositary share, each representing a 1/1,000 interest in a share of Series Y preferred stock, which is traded on the New York Stock Exchange under the symbol “WFCPrY”. The Series Y dividend is payable on March 15, 2023, to holders of record as of the close of business on Feb.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit wf shareowner services in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your medallion guarantee stamp wells fargo, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I edit medallion signature wells fargo straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing stock power in blank.

How do I fill out medallion signature guarantee wells fargo using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign does wells fargo do medallion signatures and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is wells fargo stock power?

Wells Fargo stock power is a legal document that allows a shareholder to transfer ownership of shares held in Wells Fargo to another person or entity. It functions as an endorsement on the stock certificate.

Who is required to file wells fargo stock power?

The individual or entity that owns the shares and wishes to transfer ownership is required to file the Wells Fargo stock power.

How to fill out wells fargo stock power?

To fill out Wells Fargo stock power, the owner must provide their name, the name of the transferee, the number of shares being transferred, and sign the document. It's important to ensure that all information is accurate and legible.

What is the purpose of wells fargo stock power?

The purpose of Wells Fargo stock power is to facilitate the transfer of stock ownership in a straightforward manner, helping to legally document and recognize the change of ownership.

What information must be reported on wells fargo stock power?

The information that must be reported on Wells Fargo stock power includes the name of the seller, the name of the buyer (transferee), the number of shares being transferred, the date of the transfer, and the signature of the seller.

Fill out your wells fargo medallion signature online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Does Wells Fargo Do Signature Guarantee is not the form you're looking for?Search for another form here.

Keywords relevant to does wells fargo offer medallion signature guarantee

Related to signature guarantee wells fargo

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.